A yearly fixture, many students have grown to dread the email from the Office of the President announcing a tuition increase each year. The tuition increase for the 2024-25 school year was recently announced by President Eduardo Peñalver to be 4.48%. This amounts to $2,384.93, bringing the total undergraduate tuition to $55,620 a year. While less than the 5.78% increase for this current school year, many students are still left wondering how they are going to keep affording Seattle U.

One of these students is Sophia Flamoe, a second-year marketing major. Flamoe was expecting the increase, but expressed that it is still a significant cost to her and her family’s finances.

“I was glad it was less than last year, but it’s still an increase, and we’re paying so much already,” Flamoe said.

Student financial need is one of the many factors that is taken into account when determining how much tuition should be raised according to Jordan Grant, the assistant provost for Student Financial Services (SFS). Although SFS does not determine the tuition increases, they are part of the decision-making process for how much to increase tuition by.

“We look at student financial need, that’s who our students are, how they are affording education, what their financial need looks like,” Grant said. “We also look at similar peer institutions and how our tuition rate is similar or dissimilar to those institutions.”

Grant also described how this year’s tuition increase will hopefully get back to historical trends. The university has typically raised tuition by around 3–4% every year, making last year’s increase an anomaly. SFS Associate Director of Student Accounts Sean Drew attended Seattle U as an undergraduate in the late 80s, and remembered tuition increases as being relatively consistent.

While tuition continues to rise, Drew pointed out that federal funding for higher education has stagnated. According to him, the buying power of Pell Grants and federal loans used to be much larger, meaning students had to pay much less out of pocket.

“Government loans and Pell Grants have not kept pace with the price of tuition,” Drew said. “You basically have a growing gap between what I knew I could finance versus what I had to come up with out of pocket.”

While government aid has not kept up, Drew pointed out that Seattle U provides significantly more institutional funding now than they did when he attended. In fact, Grant stated that outside of employee compensation, financial aid is one of the university’s largest expenditures. This is, according to Grant, why tuition is priced as it is.

“Institutions that are private and do not get state funding have had to find ways to help students meet the cost, because we have to charge to pay professors and keep our lights on,” Grant said. “If we have to give some of our institutional dollars through financial aid, then we have to charge a little more to cover that and pay our bills.”

SFS recognizes that tuition increases can put financial burdens on students who are trying to complete their education. One of the things they do to help relieve some of this stress is to provide extra financial resources to students whom they have identified as having the most need. Instead of waiting for students to come to them with requests, Grant says that SFS tries to be proactive in offering additional funding to those students.

“Last year the administration was able to allocate additional funding that we could then provide students who have the highest unmet financial need [because of the tuition increase],” Grant said. “We were able to provide some retention grants to students that appear to be very helpful to those students.”

While some may benefit from additional financial aid, others continue to be impacted by the tuition increase.

Mira Martin, a second-year civil engineering major, mentioned that while the cost of attendance rises, many students’ scholarships do not change.

“What I was expecting during my freshman year versus what I’m now paying is so different,” Martin said. “My financial aid package has stayed the same even though my tuition has been increased, which does not feel fair.”

In an email to The Spectator, President Eduardo Peñalver noted that to combat this, students should also be accessing Seattle U’s scholarship database, ScholarshipUniverse.

“By answering ScholarshipUniverse questions and filling out their profile, students can be matched with many scholarships—all they need to do is apply,” Peñalver wrote.

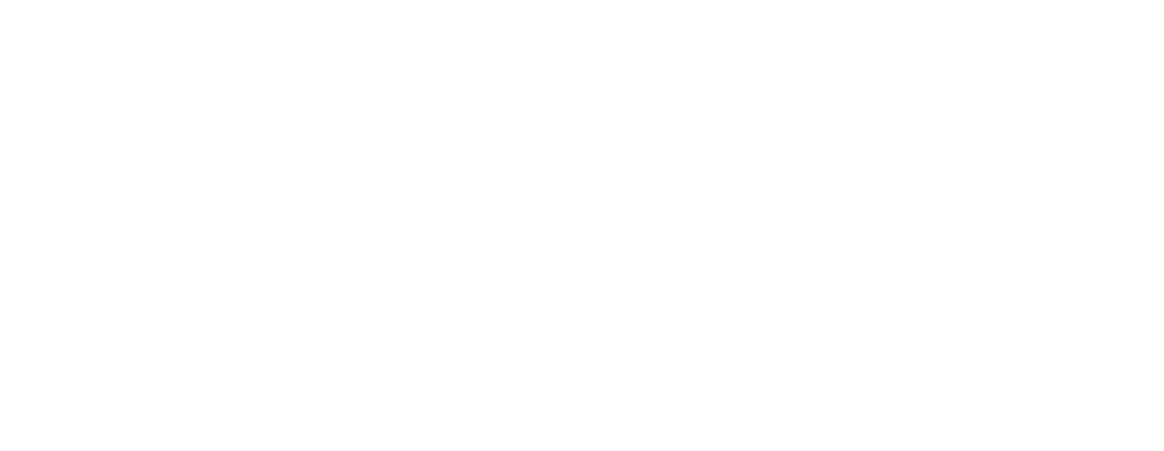

In addition to the tuition increase, the university also decreased the number of credits students can take while paying the standard tuition rate. Starting next academic year, students will be limited to 18 credits before being charged a per hour credit rate. Currently, they are allowed to take up to 20 credits without any additional fees.

Vice Provost for Student Success Melore Nielsen stated that allowing students to take 20 credits under the standard rate was a policy that the university could not continue to financially sustain.

“The 20 credit [policy] was looked at and people were saying ‘Well, why is that? Do we have [curricula] that actually requires 20 [credits]?’ Because [the university] is paying for each course and the faculty, they were saying ‘If a student is taking an additional course by choice, we’re still absorbing the cost,’” Nielsen said.

However, Martin mentioned that whether it’s for an additional major, minor or just for fun, students should be able to pursue courses outside of what is required without additional fees.

“You’re trying to get an education,” Martin said. “You shouldn’t be punished for trying to learn.”

Decreasing the number of credits that fall under the standard tuition rate also puts Seattle U in alignment with other institutions that are on the quarter system. The University of Washington, Western Washington University and Seattle Pacific University all have standard tuition rates that cover 18 credits at most.

Peñalver also stated that the coverage of 20 credits encourages students to overload their schedule—many times beyond what they are able to successfully handle. Despite this, there are currently programs that require students to take more than 18 credits in a quarter. However, these issues have been addressed.

“Academic programs that require students to take more than 18 credits in a given term will receive a waiver to accommodate the required courses,” Peñalver wrote.

Nielsen also addressed concerns regarding students who would like to pursue more than the typical three 5-credit courses per quarter, even if their curriculum does not require them to do so. She explained that increasing the number of 2-credit and 3-credit courses, and even the possibility of beginning 4-credit courses is being considered.

This would hopefully benefit students who want to take more classes or earn a minor outside of their major. Flamoe is pursuing a creative writing minor, but described how she almost chose not to after learning about the new credit cap.

“I knew about the credit cap when I chose my minor. It was a really difficult decision, and I was thinking about doing a minor closer to my major because it would be easier to achieve,” Flamoe said. “I love to write, I would honestly rather be doing that than anything else, so that’s why I ended up going with it. [The credit cap] definitely made the decision a lot harder than it needed to be.”

For students wanting to take additional courses but not go over 18 credits, Nielsen mentioned the opportunity to take classes during the summer. She recognized the fact that while courses are offered, students can’t enroll if their class is not offered. Thus, the administration and staff are focusing on increasing efforts to better the summer program. This includes surveying students’ course interests and needs, as well as promoting summer courses.

“The more interest there is, the more we can offer,” Nielsen said.

Although summer tuition is discounted at a rate of 40%, a 5-credit class will still cost $3,710. While institutional gift aid is not available during the summer quarter, federal aid can be used during this time. For students who want to take advantage of this, Grant encouraged them to fill out the summer aid application available after registering for summer classes.

Even with the new FAFSA changes, Peñalver noted that continuing student financial aid offers will still be released by late May or early June. As the cost of living continues to rise and FAFSA forms remain delayed, tuition increases and credit changes exacerbate already existing financial hardships. As a private, not-for-profit institution, Seattle U walks a delicate line between making enough money from tuition to fund educational programs while supporting students who face the constantly rising cost of attendance.