When Oct. 1 rolls around, many college students know that it’s time to begin completing the Free Application for Federal Student Aid, or FAFSA. However, this year’s Oct. 1 came and went with no FAFSA form opening up.

The lack of a FAFSA form to fill out is due to the FAFSA Simplification Act that was passed in late December 2020. The main goals of the act, as the name implies, are to make the FAFSA easier for students to complete.

According to Nick Huntington-Klein, an assistant professor of economics at Seattle University, there has been an ongoing campaign for a simpler FAFSA process.

“The FAFSA has been more complex than filling out your taxes, it’s really difficult for a lot of people,” Huntington-Klein said. “Especially since many people expect their kids to fill them out.”

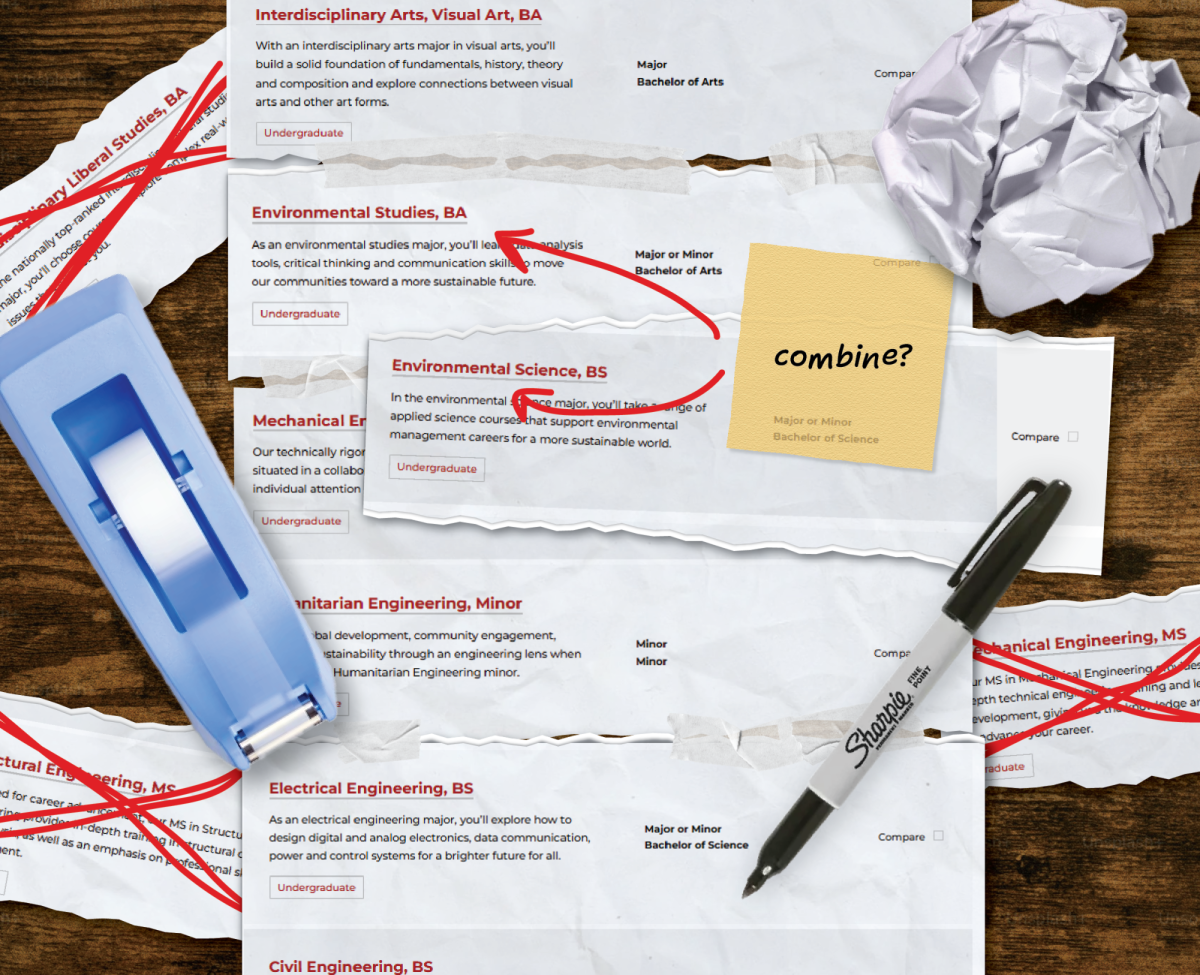

The changes to the 2024-25 FAFSA are the latest and most drastic changes that have been made to the form since the act was passed, though smaller updates have been made since the 2021-22 award year.

Jordan Grant, the assistant provost for Student Financial Services (SFS), said that this is because the Department of Education felt that the changes were too large to make all at once.

“At the [time it was passed], we thought things were going to happen much sooner,” Grant said.

A driving factor in the simplification of the FAFSA form is to make it easier for students to file, especially those who are low-income or first generation. Huntington-Klein believes that complications in the FAFSA are a large barrier of entry for low-income or first generation college students, something that has been echoed in studies.

“There’s a lot of barriers to going to college, especially if your parents didn’t go,” Huntington-Klein said. “There’s a lot of stuff that you don’t know that you have to do, and financial aid is a big part of that.”

As for the actual changes happening this year, there are a few main ones. The first is the replacement of the Estimated Family Contribution (EFC) calculation, with the Student Aid Index (SAI), which aims to better indicate to students what the number represents.

Amber Brockel, the assistant director of student communications at SFS, says students often express concerns that the EFC represents the actual amount their parents are expected to pay.

“I think it is probably going to be a better measure and indicator,” Brockel said. “I think the SAI will be much more clear for students to understand.”

There will also be changes in how the number is calculated. Students may now receive a negative number for SAI, where the EFC previously began at zero. Another large change is the removal of the number of college students in one’s household from the calculation.

This revelation has been alarming to some students, such as Naho Umitani, a second-year economics and public affairs double major.

Umitani has a younger sister who will be attending college next year, and as a student who is dependent on government financial aid, she worries about what effect this change will have on her college experience. Umitani also serves as the at-large senator for the Student Government of Seattle University (SGSU), which she may not be able to continue if her financial aid decreases.

“If my financial aid were to change, my work with student government would probably change as well,” Umitani said. “I would have to devote my time to work.”

Despite this concern, Seattle U students who have siblings in college may not have to worry about these differences. As explained by Grant, the number of children in college does not have a large impact on federal aid calculations. If students do find that it impacts their aid, he says that they can ask SFS for help.

“For eligibility for the federal government, they are very concerned about Pell Grant, and [the number of students in college] had very little impact,” Grant said.

A further change in the calculation of SAI comes if students live on a farm or have parents who own a small business. In the previous EFC calculation, students were not required to report these as assets if the farm was their main place of residence, or if the small business had less than 100 employees. The SAI now requires that this information be disclosed, and is now included in a family’s wealth.

For students who are concerned about any potential decreases to their financial aid, Seattle U’s guaranteed gift aid policy ensures that students will not see any change in the money they are receiving from the university itself. Grant explained that students are also welcome to come discuss getting increases in institutional financial aid if their federal aid changes.

“We have some special liberties to help students who those changes are actually impactful for,”

Grant said. “They can come talk to us about ways in which we can account for those costs their contributors are experiencing.”

Students will also see changes in how they enter their financial information on the FAFSA. The form will now use the IRS Data Exchange. This means that instead of entering any relevant financial information manually, students will have to consent to the IRS sending their data directly to the form. Brockel hopes that this will help streamline the application process for students, and reduce potential errors students make when filling out the FAFSA.

“Hopefully it will make the process smoother and less time-consuming, because [students] won’t have to look for all of those line items on the tax return,” Brockel said.

This change also alters how parents or spouses are labeled on the FAFSA. Now, one umbrella term of “contributor” will be used on the form. A contributor could be a parent, guardian, spouse or anyone else who financially supports a student. After a student fills out the application, anyone that the form identifies as a contributor will be sent a message that they have to enter their data on the form. According to Grant, these people must then consent to the IRS Data Exchange, or the student will not be eligible for financial aid.

Another large change to the FAFSA is Pell Grant eligibility. The Federal Pell Grant program is designed to provide students with great financial need money to attend college that does not need to be repaid. Grant is hopeful that this expanded eligibility will reduce students’ need to borrow money to pay for college. With a current student loan debt of over $1.7 trillion, affordability of higher education has been of increasing concern to students.

With growing anxieties about the affordability of college, SGSU has been working to make financial resources more accessible. Along with fellow senator Umitani, SGSU’s Student Employee Senator and Second-year Political Science and Public Affairs double major Jacob Caddali has been working to better centralize Seattle U’s existing financial resources, with the goal of making funds more accessible to students.

“A lot of it has to do with marketing and specifying the specific resources that are on campus right now,” Caddali said. “[I am] trying to centralize information and market better financial resource information…and trying to gear SU’s approach for students less on having them take loans.”

SGSU’s motivation to ensure that resources are advertised and made accessible for students was partially due to last year’s 5.78% tuition increase for undergraduate students. SGSU passed a financial resolution that asked administration to be more transparent about finances and give students more communication about potential changes.

“It caught a ton of students off-guard,” Caddali said. “So part of the resolution also focused on emphasizing that a university should take more proactive action in making sure they can relay this information fast enough.”

In regards to information about FAFSA, Caddali has been working with SFS, Student Persistence and Learning Assistance Programs on sharing programming about these changes to students. Students may have seen flyers up around campus communicating the changes. SFS is hosting webinars about FAFSA simplification, with the next one happening Nov. 15 at 4 p.m. The SFS office also has counselors who are able to meet with students about any potential financial aid questions.

As for when students can expect to fill out the new FAFSA, there is no date set as of yet, only that the form will be open sometime in December. While the priority deadline for submitting your FAFSA to Seattle U will remain Feb. 1, Grant acknowledges that the shorter timeline may prove to be a challenge for some students.

“Once we get word of when the FAFSA is being released we will make announcements to students,” Grant said. “We are aware that if it is released late December, one month is not enough of a turnaround time, so we do welcome FAFSAs after that date.”

While it remains to be seen what effects a simplified FAFSA form will have on students’ aid, there is hope that it will help remove barriers of entry to higher education for some students, and lead to an easier filing process for all.