Imagine a room full of toddlers in suits.

Because that’s pretty much the way things have been working in the House of Representatives for the past couple of weeks, if not years—the government shutdown is getting a little childish.

If lawmakers refuse to raise the debt ceiling by Oct. 17, the government will run out of money to pay all of its bills.

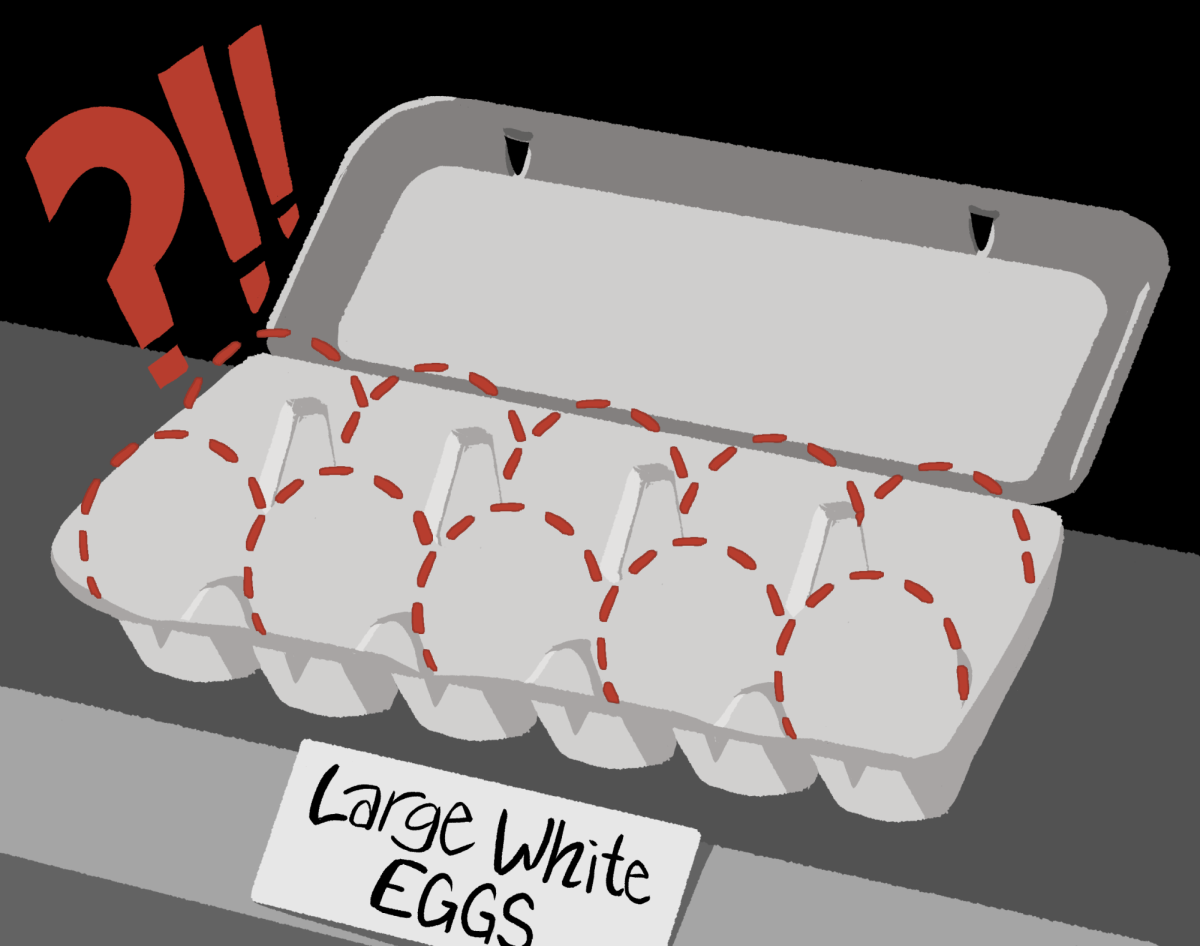

Protestors hold signs during a during an event with the Democratic Progressive Caucus and furloughed federal employees on Capitol Hill in Washington, Friday, Oct. 4, 2013, as the budget battle continued. President Barack Obama decided to stay home from economic summits in Asia as Democrats stepped up pressure on congressional Republicans to rein in their tea party faction and reopen the government with no strings attached.

Each month the government has roughly $80 million-worth of bills to pay, according to an interview with Cardiff Garcia, a reporter at the Financial Times on wbur.org. This money is used to supply people with social security, pay for the military, et cetera.

The government accumulates the revenues to pay these bills mostly through taxes. When the government can’t make enough money from these taxes, a gap appears between what the government owes and what it has. This is called the budget deficit and, to make up for the deficit, the government must borrow money—thus debt accumulates.

Years ago, Congress passed a law limiting the amount of debt the government was allowed to accumulate and Congress has voted to raise the debt ceiling 78 times since 1960 in order to keep the government from defaulting.

However, at the present moment Congress, or more specifically Speaker John Boehner, is refusing to vote to raise the debt ceiling unless the Senate and White House agree to several demands. Chief among these demands is the gutting of President Obama’s signature health care initiative the Affordable Care Act.

If the government hits the debt ceiling on what is being called “X-Date” by the mainstream media, it will have, according to The New York Times, about $30 billion in liquid assets to pay its bills. This would effectively mean that the U.S. Treasury, the department that handles the government’s bill paying, would have to pick and choose which bills get paid and which ones do not.

Estimates by Bloomberg.com claim that about 30 percent of the government’s aforementioned monthly bills would simply not be paid in perpetuity until the debt ceiling was raised.

This would have implications on several fronts. First, according to Annie Lowrey in an interview with PBS.org, some social security and payments to states and the military wouldn’t be paid. Second, there would be a default on U.S. Treasury bonds, which are often used as collateral against government borrowing and are in circulation worldwide.

It is the first effect that worries Americans on the home front given that many citizens, including many university students, rely on federal aid to pay bills and would suffer if the government was unable to supply them with money.

It is the latter effect however, or a default on U.S. bonds, that has world leaders anxious about the current problems in Washington.

According to Lowrey, a failure by the treasury to pay bondholders would trigger a global financial meltdown. She used the phrase, “mother of all financial crises,” given that bonds, particularly U.S.

Treasury bonds, play such a key role in the function of global markets as the viability of the U.S. Government has never before been questioned.

In fact, markets are already experiencing tremors triggered by the approach of X-Date, similar to the way they did in 2011 when the U.S. flirted with another default.

However, in opposition to these doomsday forecasts reporting the dire consequences of not raising the debt ceiling, a faction of congressional Republicans disputing the implications of a default has risen.

According to an article in The New York Times, “a surprisingly large section of the Republican Party is convinced that a threat once taken as economic fact may not exist—or at least may not be so serious.”

The judgment here relies on the belief that, in the event of a default, the government will be forced to balance its budget presumably by cutting government programs or raising taxes. However, as the public has seen again and again, lawmakers are hesitant to raise taxes on any consumer group.

No matter the consequences of a default, however, the fact that the government is in gridlock while we approach the debt ceiling should be alarming. It would appear as if America’s elected officials, particularly those in the House, are willing to risk economic fallout over demands regarding legislation passed in 2010.